Services

Restructuring including liquidation arrangement

There are currently four restructuring proceedings available in Poland, of which the arrangement approval proceedings is by far the most popular. According to data as of the end of 2023, it accounts for approximately 92% of all restructurings opened in our country in 2023

(source: https://www.mgbi.pl/raporty/postepowania-upadlosciowe-i-restrukturyzacyjne-raport-2024/).

Each of the restructuring proceedings has its own specificities, advantages and disadvantages, which is why we believe that the choice of one of them should be preceded by a prior analysis of the company in question, taking into account the Client’s business objectives.

We know from experience that the wrong choice of an appropriate procedure may be difficult to rectify at a later stage, which is why we do not always recommend the currently most popular arrangement approval procedure as the best solution to the Client’s problems. In some cases, it will be in the Client’s interest to initiate a more formalised and longer judicial restructuring procedure or to carry out a completely out-of-court restructuring.

The following is a brief description of each of the four restructuring proceedings currently available.

Arrangement approval proceedings

The arrangement approval proceedings (also abbreviated as AAP) is the simplest, quickest and most efficient restructuring procedure. It is initiated and almost entirely conducted by the supervisor of the arrangement (chosen by the debtor himself). Only at the final stage does it require the involvement of the court approving the arrangement.

AAP is available to an entity both insolvent and just at risk of insolvency. It can be initiated practically overnight, without having to wait for a long time for a court decision, as is the case with other, judicial restructuring proceedings.

In these proceedings, it is possible to obtain full protection from enforcement (stay of enforcement) and the termination by creditors of key contracts for the running of the business.

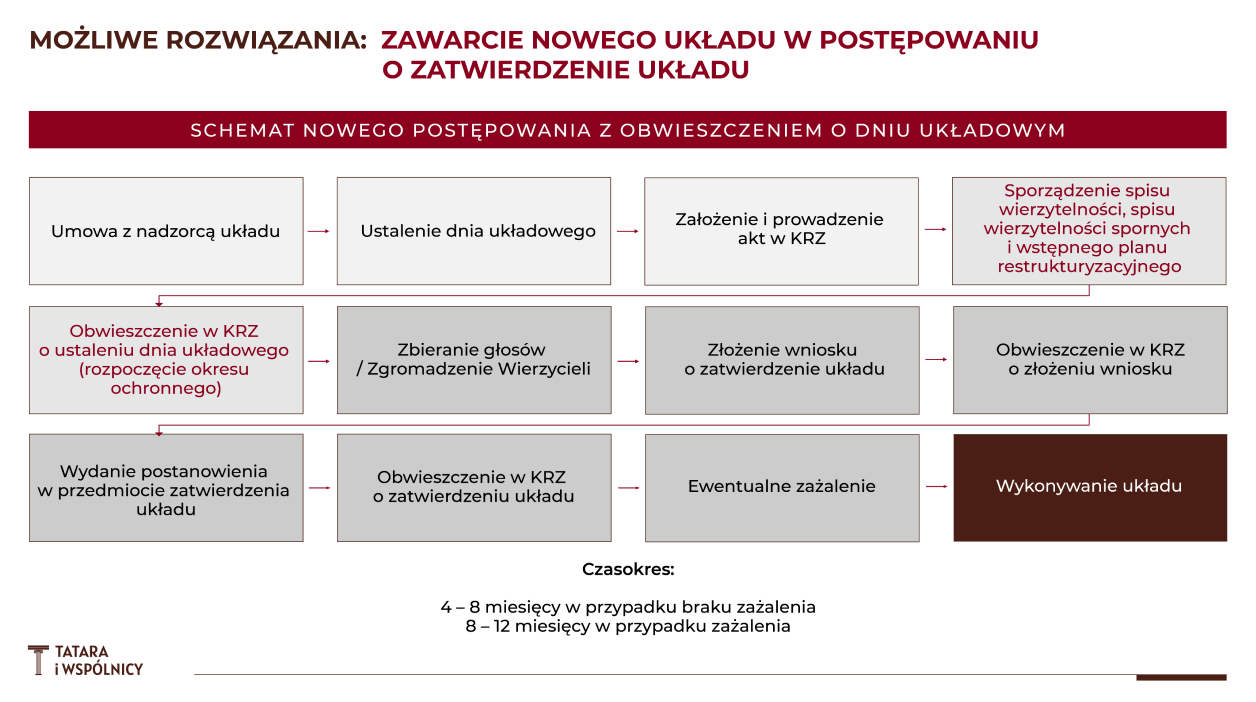

The AAP course and framework can be illustrated by the diagram below:

Below is a brief introduction to AAP in an accessible video format:

AAP is an interesting form of restructuring also for the reason that it can include a partial arrangement with only some of the creditors – key and crucial to the continued running of the company.

In these proceedings, a liquidation arrangement may also be concluded assuming the sale of all or part of the enterprise, e.g. to an investor indicated in the arrangement. A liquidation arrangement may also provide for the deletion (striking off) of the entity from the National Court Register (Krajowy Rejestr Zadłużonych), which may be a good alternative to its liquidation under the provisions of the Commercial Companies Code.

According to the planned amendments to the restructuring law (aimed at implementing Directive 2019/1023 – the so-called ‘Second Chance Directive’ – into the Polish legal framework), the liquidation arrangement will also have the effects of an execution sale, which will make this form of restructuring even more attractive to potential investors.

Our team has successfully conducted a number of such proceedings, including using partial and liquidation arrangements for a number of our clients – both micro and large entrepreneurs, including WSE-listed companies. The vast majority of our proceedings have been successful in the form of final approval of the arrangement, which has subsequently been implemented or is in the process of being implemented and arrangement performance.

Together with our restructuring company Alerion sp. z o.o. (www.alerion.pl) we have the resources, the necessary qualifications and the experience to carry out even the most complex arrangement approval proceedings.

We encourage you to read references from our clients and descriptions of selected AAPs we have carried out.

Accelerated arrangement proceedings/arrangement proceedings

In some cases, the application of an arrangement approval proceedings is not advisable (e.g. due to its short duration) or its initiation may be insufficient or even formally inadmissible. In such a situation, the initiation of a court restructuring procedure – the accelerated arrangement proceedings – may become an appropriate solution. This is the fastest form of court-ordered restructuring currently available – a court decision is required to initiate it and it may take from 6 to 12 months.

This procedure is only available to debtors who do not have a high level of disputed debts (max. 15% of total liabilities) and who, for various reasons, need more time to address and clean (sort out) the company’s processes and conduct additional negotiations with their creditors with the assurance of protection from enforcement.

Partial arrangements and liquidation arrangements are also possible with these proceedings.

The Tatara and Partners team has extensive experience in advising on the preparation of applications for the opening of accelerated arrangement proceedings, as well as in the subsequent legal support of debtors and creditors during such proceedings.

The arrangement proceedings is a court procedure similar to the accelerated arrangement proceedings, but more lengthy. It is available to debtors who have a high level of disputed debts (more than 15% of total liabilities). Arrangement proceedings (fast-track or ‘ordinary’) will not usually be a good choice if the restructuring of the liabilities in the arrangement alone is insufficient and other restructuring measures need to be implemented to rehabilitate the company.

Remedial proceedings

In some cases, in addition to the restructuring of liabilities itself, the debtor’s company requires the implementation of additional restructuring measures. In such a situation, the optimal form of judicial restructuring may be a remedial proceedings. Within its framework, it is possible to carry out remedial measures, such as withdrawal from unprofitable contracts, reduction of employment or sale of certain assets with enforcement / execution sale effect (i.e. with expiry of mortgages, pledges, etc.).

The biggest disadvantage of the remedial proceedings is its long duration (1-4 years) and the associated uncertainty as well as greatest risk of failure.

In contrast, an interesting option available in these proceedings is the possibility of selling the business or an organised part of it with the effect of an execution sale, i.e. as in bankruptcy.

Members of our Team have participated in a number of successful remedial proceedings – as attorneys for the debtor and as persons acting as administrators appointed by the restructuring court in the debtor’s remedial proceedings.

SERVICES

Our offer includes:

News